Best Finance and Accounting Business Process Outsourcing Providers Reviews 2023

The running worry is that your business’ financials are too complex, nuanced—or maybe just so poorly kept-up—that an outsourced financial provider wouldn’t be able to help. This is the theory that too many cooks in the kitchen will only complicate things further. The key is to determine the amount, type, and timeframe you have to work with. We provide thorough and comprehensive accounting services wherein we handle your accounting books remotely with precision. Our finance professionals are highly proficient in using the most popular accounting and finance software to handle all finance requirements.

These are some benefits of financial accounting outsourcing for the business organization. However, software would involve certain and also training would be needed for handling the cost. Financial accounting outsourcing can get the access to the latest and relevant software to handle the accounting activities. You may not have to buy the accounting software separately for handling the accounting in Outsourced Financial Services. We were initially skeptical, having previously tried to outsource some of our accounting functions, without success.

Payroll

If you cannot handle a full-time, in-house staff, outsourced finance and accounting services may be the right choice for you. You will benefit from timely financial statements to improve your financial visibility and reflect your company’s activity and progress without the hassle of managing multiple people. Outsourcing this function will eliminate the need to manage sick leave, vacation time, or other workplace disruptions. Over the past decade, many companies have decided to outsource these functions to professionals because they can have a tremendous long-term impact on their business. Is it time to invest in additional people and new software to boost your business’ efficiency? Outsourcing some or all financial processes can allow your company more time to focus on core parts of your growing business, offering better opportunities in the long run.

Your provider will keep abreast of financial data in a way that will eliminate fraud, malpractice, or corruption within your company, no matter how big or how small. In managing this data, your provider must assume an eagle-eye approach with regard to how your company’s leadership realistically fulfills all its financial goals. These figures should serve as a rough guideline to estimate the range of your budget for outsourced finance services. Therefore, outsourcing cuts much of the cost that comes with having an in-house team but still allows you to work with the best professionals in the F&A industry. In the real estate industry, virtual assistants are remote workers that handle data entry, calendar management, appointment scheduling, and other administrative tasks.

Company

It is a bit cost-effective to obtain IBM Finance and Accounting Business Process Outsourcing Services. A knowledgeable, responsive and innovative partner that has helped fill the gap and find solutions to operational needs. “Fundamental to find the right partner, one who goes beyond standard processing.” Compliance with regulatory requirements and expectations can be a challenge for growing companies. Keeping up with new and changing financial regulations requires constant monitoring and a highly skilled technical workforce. Discover which benefits you can leverage as part of the M&A and carve-out process.

Guiding them right to achieve their financial services on time is an important aspect of a bank to’s success. Outsourcing your customer support in a country like India can continually carry out the responsibility at a very affordable price. If you don’t have the resources to hire a full-time in house department, outsourcing it to a dedicated skilled team is the way to go. Outsourcing such services can provide a better turnaround time on identifying, prospecting qualified leads, and scheduling meetings with clients. The average salary for an accountant in the United States is about $64,000 per year.

Monitoring of financial policies of the organization will ensure that there is adherence to different rules and regulations. A specialized accounting outsourcing firm can give you back time and peace of mind by taking care of such back office functions as finance and accounting so you can focus on growing your business. It also allows you to enjoy benefits including cost savings, security and confidentiality, access to the latest tech tools, among other features. Additionally, you’ll experience a variety of benefits when you outsource these financial services from our network. Handling bookkeeping and financial administration tasks internally takes away time and resources from your most essential business operations. For a more strategic approach, why not outsource bookkeeping and financial reporting services from a specialist?

Therefore, outsourcing these important tasks to a service provider can help you save time. The expert outsourcing provider efficiently handles this non-core still imperative business operations so that you can put more time and energy into other core banking activities. However, some organizations prefer outsourcing the Finance function to third-party providers. Financial Process Outsourcing is the procedure in which the financial management function is carried out by an external agency. An organization requiring the financial process will sub-contract the process to a third-party service provider. Read what other clients have to say about the outsourcing provider’s performance, employees, and quality of work.

Here, Outsourced Accounting Services can relieve the business owners from getting involved in these things and focus more on business. It may not be always possible for all the small and medium size companies to get better quality accountants working in-house. Outsourcing financial accounting will help to get talented accountants to work on you. CFOs are under increasing pressures to reduce costs, improve productivity and increase their team’s focus on higher value activities. In addition, US wages have been going up and unemployment levels are at their lowest level in nearly 50 years.

Proper finance management plays a vital role in determining the success and failure of every business. Manpower constraints can burden the accounting team as they must handle tons of data. If you’re still looking for a reason to start outsourcing finance activities, then look no further. Tax accounting entails data with regard to tax income returns and necessary tax payments for your industry type and according to your area’s bylaws. Bookkeeping is a cornerstone process in which a company’s total earnings and expenses are tallied.

Banks and lending institutions sometimes outsource their customer acquisition to a capable third party. By doing so, their organization can create a sustainable acquisition strategy and process, keep up with industry trends, and continually grow and gain new clients with ease. Finally, eCommerce and digital business owners can have the privilege of using the financial and accounting help they need. CFOs are under increasing pressures to optimize costs, improve productivity and increase their team’s focus on higher value activities. Your company’s financials will be rigorously maintained, and you will be set up on a cloud-based platform to provide maximum visibility on-demand.

Lack trust in financial data

Financial controllers oversee all of a company’s accounting activities, ensuring that the ledgers accurately reflect all financial transactions. Banks, lending institutions, insurance companies, and real estate businesses are the sectors most in need of outsourced financial services specific to the functions they render. The professionals in charge of this outsourcing solution will handle salary computations, employee tax and ensure that everything complies with labor laws. These comprehensive solutions will allow your business to save time, save money, and make measurably better strategic choices.

This data is used to drive better decisions, eliminate inefficiencies, and take advantage of the opportunities that may arise. Whether you require a CFO, a controller, an accountant, or an entire department of financial experts, our solutions will scale with you. Together, we can optimize your financial and accounting practices, paving the way forward to achieve your business goals. And one of the most popular areas for outsourcing has become financial services. If your worry is that your financials are too nuanced, complex, or disorganized, start with one outsourced service, like accounts payable/receivable, to define what that help would do. Then, after a period of time, evaluate to see if the outsourced provider could take additional responsibilities off your hands.

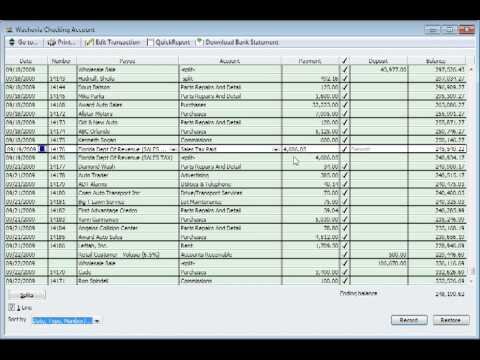

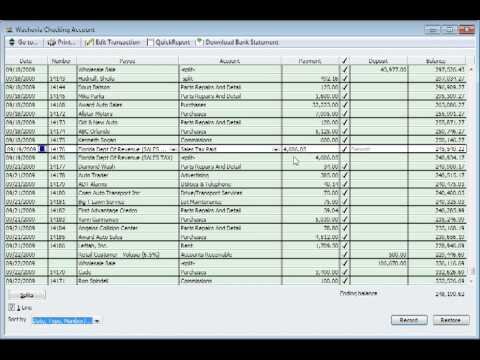

Furthermore, you’ll get the opportunity to strategically outsource your accounting while maintaining a core finance team. Therefore, it is essential not to spend too much time managing the finance of the business. Hence, financial process outsourcing can help your organization concentrate on core activities. The non-core activities of the business, such as managing finance, can be transferred and handled by the outsourcing provider. Finally, outsourced financial services remove worries about background problems such as accounting software. Most outsourcing firms maintain state-of-the-art accounting systems that offer streamlined accounting as well as data-driven reports and management analysis.

- Under the leadership guidance of our CFOs (or we can support yours), we work to provide best practice finance and accounting services that will protect your business and set you up for great success.

- However, businesses might also get ignored by financial outsourcing giants and might prefer a small firm that gives them more attention.

- The outsourcing provider must make sure that there is no form of information breach in the data use.

- You can even set goals, milestones, and also ensure smooth task collaboration between your in-house and outsourced teams.

- This type of automation and mobility will allow you to have real-time, accurate financials delivered to you instantly.

- Bookkeeping usually looks like an easy task to do, but it often can become too manual and technical.

Outsourcing your financial services is cost-effective than employing in-house staff to handle customer support, back-office, and generating sales for your business. With outsourcing, you can also get rid of the overhead costs Petty Cash Book: Types, Diagrams & Examples of hiring that an agent would generate, such as PF, health insurance, retirement, etc. Investing a lot of time in back-office activities, lead generation, and customer experience is not a good choice for your business.

Latest Articles & Resources

As a result, you’ll enjoy expert advice, streamlined processes and the freedom to focus on what matters most. Payroll is one of those functions that companies, especially small businesses with minimal staff struggle to manage. If you don’t have the budget and the resources to work with an accounting firm, it makes sense to contract an outsourced payroll department. Small-size businesses sometimes struggle to fully manage all accounting functions with their internal employees. For instance, your current finance team might be good at controller services but finds other tasks like audits and corporate tax difficult. One factor with a significant role to play in this aspect, especially when a business’s financial department is concerned is outsourced financial services.

The right combination of outsourced services will be unique to your business, so don’t settle for off-the-shelf solutions. An outsourced finance team is hand-picked best-in-class individuals, providing higher quality results and expertise than in-house employees. Outsourcing financial operations creates consistency, avoids the headache of churn, and ensures best practices are being employed. A lot of cost is incurred to handle in-house financial accounting like hiring process, training process, payroll management, etc. Outsourcing will eliminate all these costs and help save a lot of money for the organization.

Bookkeeping usually looks like an easy task to do, but it often can become too manual and technical. Bookkeeping takes away many resources that are better spent on higher-value tasks. By outsourcing some or all of your bookkeeping tasks, you can get your employees to focus on more important functions that your clients are expecting from you. Moreover, bookkeepers don’t need extensive knowledge of the company in question, making it a prime service to outsource, thereby saving you time and increasing the value of your work. You can scale up your outsourced financial services, if demand permits, without needing to employ in-house staff. You can also rely on the outsourced team to keep you compliant with ever-changing financial regulations as you expand your landscape.

For most budding companies, accomplishing those financial directives in-house is a Sisyphean task. But by outsourcing their financial services, such objectives become much more attainable. Digitalism had already accelerated the adoption of this business practice, moving it from a purely cost-saving measure to an integral aspect of a modern corporate strategy.